Unknown Facts About Best Financial Planner Melbourne

Currently, there are some home mortgage brokers that do bill a little bit by method of a retainer, yet that's often then paid back to the customer if they complete the finance," claims Edge."One false impression is that, because home loan brokers generally make money by the bank, the rate of interest is mosting likely to be greater.

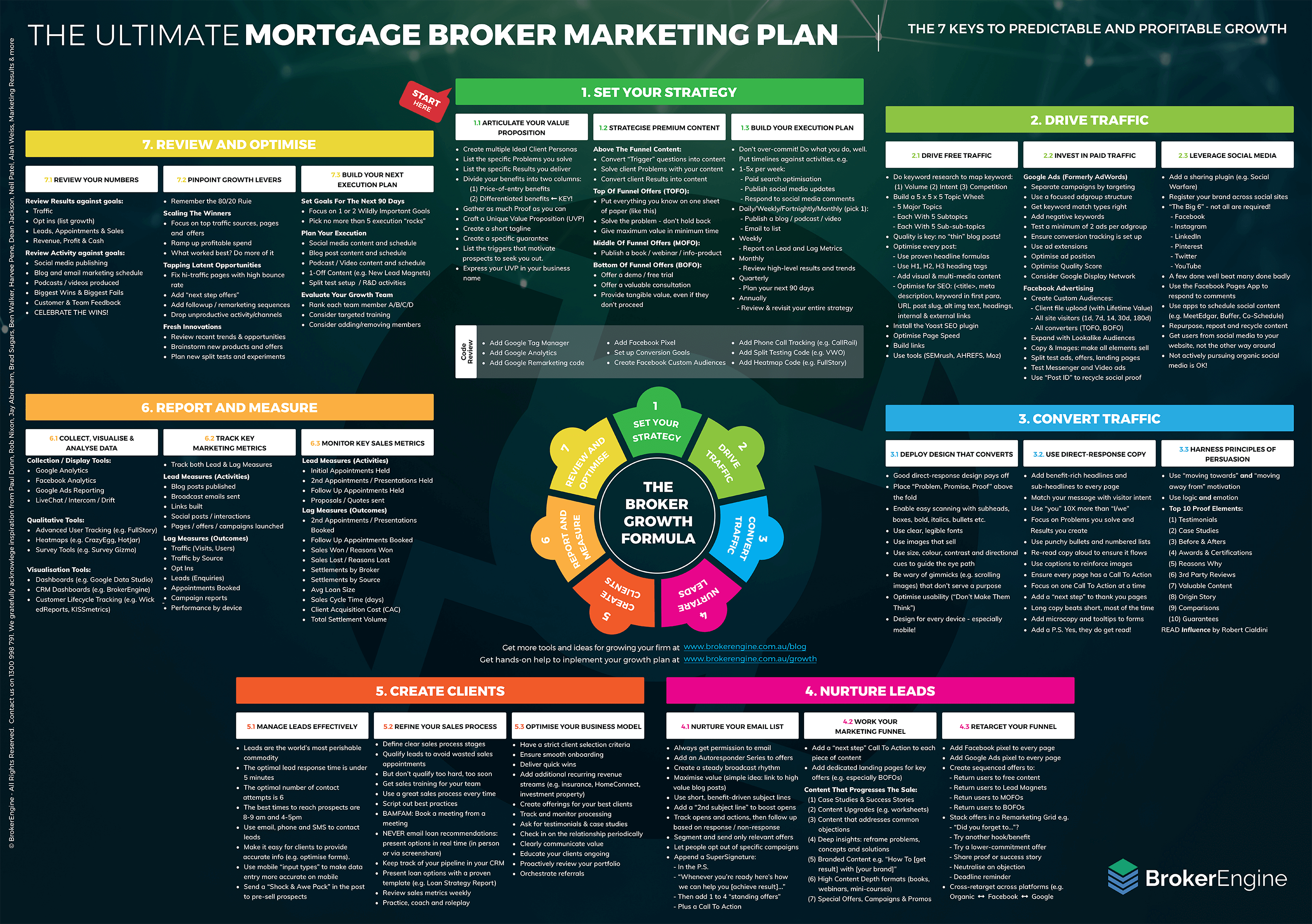

"So if brokers are being paid by lending institutions, just how can debtors be certain that their broker really has their finest interests at heart?"Referrals are actually crucial right here - so speaking to people that have actually made use of a specific mortgage broker prior to that they have actually been pleased with.

The smart Trick of Best Financial Planner Melbourne That Nobody is Discussing

A broker that handles whatever themselves may have a slower mortgage pipeline Do they have favorable on-line evaluations from previous clients? If they recommended a certain loan, why that one? And are there less costly choices offered?

My basic recommendations is that people need to think about making use of a broker because they do offer a lot more options than simply going to a bank."Especially in today's rate of interest environment, it's certainly worth having that discussion with a broker to see if they can re-finance your present loan to a much better price.".

About Melbourne Finance Broking

Buying a new home is an exciting time, but it can also be a little daunting if try this site you do not have the right knowledge and assistance to help you via the procedure. Among the manner ins which numerous people get assistance when buying a building is making use of the solutions of a home loan broker, that supplies recommendations and suggestions on selecting the best product.

While it's something to pick a broker even if that's what other individuals have actually done, it can be practical to recognize exactly what benefits making use of one will certainly provide you. With this in mind, right here are our top 7 advantages of utilizing a mortgage broker (melbourne finance broker). Looking into the home loan market for the right bargain can be really time consuming, which is fine if you have browse around these guys several hours going extra

If you make use of a broker, you'll be obtaining advice from someone who already knows the market and will certainly invest time combing it for an excellent bargain, which suggests you do not need to. In addition to time, you might also save cash by utilizing a home mortgage broker. Not just are you getting an expert who can locate a bargain, but you're getting someone that will certainly evaluate your needs and make a recommendation that is appropriate for you economically.

Things about Melbourne Finance Broking

Along with suggesting you on documents issues, a mortgage broker can likewise deal with the application procedure and keep you educated of its progress with a lending institution. This can be indispensable at such an active time of your life, leaving you complimentary to focus on various other details that might do with your focus.

When you get a home mortgage, it's highly suggested that you use for insurance policy to safeguard you in the future - melbourne finance broking. The similarity life, home and essential disease insurance coverage can aid to ensure that you and your enjoyed ones are dealt with if the worst must take place. This is a location that your broker can generally help you read with.